In the realm of UK banking, What Is a Sort Code in Banking? remains one of the most essential questions for both new and experienced bank users. This detailed article is designed to unravel every layer of this topic, from the very basics to its significance in the digital age, providing UK readers with a comprehensive understanding of how sort codes are integral to everyday financial transactions.

What Makes Sort Codes the Backbone of UK Banking?

Sort codes are the unsung heroes that ensure billions of pounds move securely and accurately between banks every day. In the complex world of finance, they serve as precise navigational aids within the banking system. Without sort codes, directing money accurately would be a cumbersome task.

How Do Sort Codes Enhance Banking Efficiency?

- Accurate Routing: Sort codes help in pinpointing the exact bank branch for any transaction, ensuring funds reach the correct destination without delay.

- Error Minimisation: By providing a unique identification method, sort codes significantly reduce the risk of transaction mistakes.

- Streamlined Operations: The standardized structure simplifies the processing of payments, making it easier for banks to handle high volumes of transactions seamlessly.

This robustness is why sort codes are not just numbers—they are the backbone supporting the entire structure of banking transactions.

What Is a Sort Code in Banking, and Why Is It Crucial?

A sort code is essentially a six-digit identifier used to distinguish a specific bank and its branch location. But there is so much more beneath the surface. Here’s why sort codes are indispensable:

- Unique Identifier: They distinguish one branch from another, ensuring that every transaction is directed to the precise location.

- Routing Efficiency: During financial operations, such as transfers or direct debits, sort codes act like a map guiding funds to the correct account.

- Security Assurance: They add a layer of authentication, verifying that funds are sent to and received from verified banking institutions.

Understanding these attributes is critical to appreciating the continuous trust placed in sort codes by the UK’s financial community.

How Did Sort Codes Evolve in the UK Banking System?

Sort codes have a rich history that mirrors the evolution of the UK’s banking infrastructure. They emerged from a need for a more efficient system in the mid-20th century and have evolved alongside modern technology.

Timeline of Evolution:

| Era | Development | Impact on Banking |

| 1940s-1950s | Manual payment processing sorted via rudimentary codes | Transition from paper-based sorting to systematic identification |

| 1970s | Standardisation across all major banks | Uniformity ensured consistent and error-free transactions |

| 2000s | Digital integration into online banking services | Increased speed and security in fund transfers |

| Present Day | Real-time processing and enhanced cybersecurity measures | Instantaneous and secure banking operations |

These stages show how sort codes not only kept pace with technological advancements but also enhanced the stability and efficiency of financial operations throughout the years.

Are Sort Codes Still Relevant in the Digital Age of Banking?

Absolutely. In today’s environment, where financial transactions can occur in milliseconds, sort codes continue to play a pivotal role. Their continued relevance is evident in several key areas:

Why Do They Remain Essential?

- Digital Verification: Even as banking becomes more digital, sort codes are instrumental in validating user transactions.

- Consistency: They provide a permanent method of identification that stands up to the dynamic nature of modern banking technologies.

- Global Influence: While primarily a UK tool, the concept of using a branch identifier is recognized globally in various forms, ensuring interoperability with international systems.

By maintaining a balance between traditional banking practices and modern technology, sort codes ensure that every transaction is secured and accurately processed.

What Is the Detailed Structure of a Sort Code, and How Does It Work?

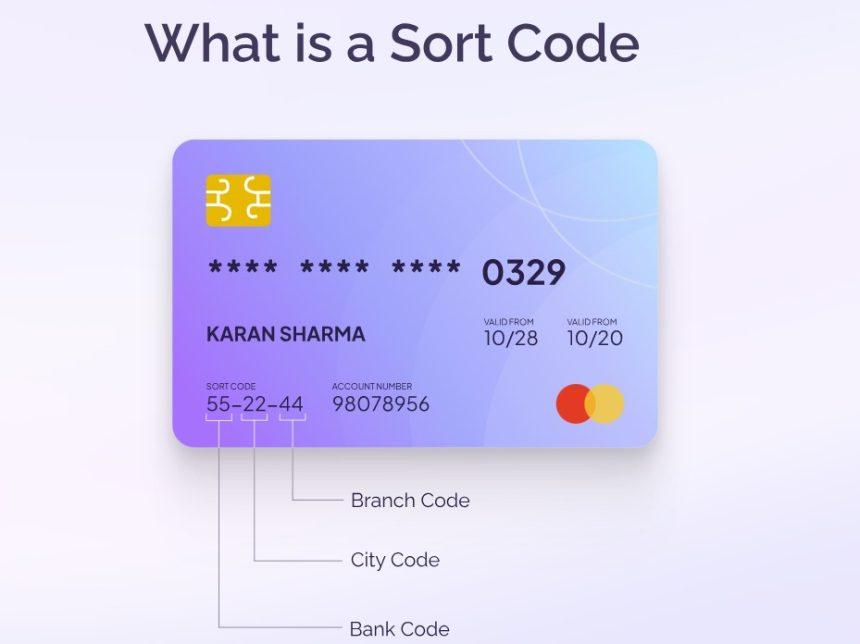

A typical sort code is composed of six digits, arranged in three pairs. Each pair plays a distinct role in pinpointing the bank branch involved.

Breaking Down the Structure:

| Component | Digits | Function |

| Bank Identifier | 1-2 | Determines the banking institution or group |

| Branch Locator | 3-4 | Specifies the exact branch of the bank |

| Operational Unit | 5-6 | Offers additional details to ensure precise routing |

This structure is meticulously designed to ensure that all transactions are directed accurately and efficiently. Understanding this format helps demystify what might seem like just a set of numbers.

How Do Interbank Transactions Depend on Sort Codes?

When you carry out a bank transfer or set up a direct debit, sort codes are the silent workhorses ensuring that funds reach their intended destination. The process is straightforward yet robust:

- User Input: The sender enters the recipient’s sort code along with their account number.

- Verification Process: The banking system checks the sort code to confirm the bank and branch.

- Transaction Execution: Funds are then securely and swiftly routed to the specified branch.

What Are the Benefits of This System?

- Speed: Transactions are executed swiftly due to automated routing.

- Accuracy: The verification step minimizes the potential for human error.

- Security: It ensures that sensitive financial data is consistently protected through standardized checks.

These steps highlight why sort codes are critical for seamless financial interactions in our daily lives.

How Will Future Banking Trends Influence Sort Codes?

Looking ahead, sort codes are set to adapt further as the banking environment evolves. Anticipated trends include:

What Innovations Could Impact Their Future Role?

- Further Digital Integration: As mobile banking and fintech innovations grow, sort codes will become even more embedded into digital transaction systems.

- Enhanced Security Protocols: With cyber threats on the rise, additional layers of security and verification will be integrated to protect sort code functionalities.

- Interoperability with Global Systems: Increased globalization of financial services might lead to better interoperability between UK sort codes and international banking identifiers, ensuring smoother cross-border transactions.

These trends signify that sort codes are not a relic of the past but a dynamic element set to evolve along with global financial technologies.

What Additional Details Should You Know About Sort Codes?

Real-World Applications and Case Studies

- Direct Debits: Sort codes play a key role in recurring payments like utility bills by making sure the money is withdrawn from the right bank account.

- Online Banking: With the expansion of digital wallets and online banking, sort codes continue to aid in verifying account details during fund transfers.

- Business Transactions: Businesses rely on sort codes for bulk transactions, payroll, and managing supplier payments, making these codes an integral part of operational success.

How Do They Integrate with Other Banking Systems?

Sort codes and account numbers function together to provide a two-layered method of verifying banking details. For example, while the account number identifies an individual account, the sort code directs the transaction to the correct branch, thereby providing an extra level of security and reliability.

Final Thoughts: How Are Sort Codes Evolving in Today’s Digital Banking Landscape?

The in-depth exploration of What Is a Sort Code in Banking? reveals that these codes are much more than a numerical identifier—they are a cornerstone of modern UK banking. From ensuring the seamless routing of transactions to evolving alongside technological innovations, sort codes remain vital in safeguarding our financial infrastructure.

As UK banking continues to innovate, sort codes will play a transformative role in:

- Securing digital transactions

- Enabling faster, error-free transfers

- Supporting the scalability of global financial integrations

For UK consumers and financial professionals, understanding sort codes is crucial for navigating today’s dynamic financial landscape with confidence and precision.

What Are the Frequently Asked Questions (FAQs) on Sort Codes?

What exactly is a sort code?

In the UK, a sort code is a distinct six-digit number used to pinpoint both the bank and its specific branch.

Why is it crucial for my bank transfers?

A sort code helps route payments precisely to the correct bank branch, minimizing mistakes and boosting the safety of financial transactions.

How has the system adapted to technological advancements?

Over time, sort codes have evolved from manual systems into integrated digital solutions, reflecting advancements in banking technology.

Are sort codes likely to be replaced in the future?

Given their critical role in secure transactions, sort codes are expected to remain relevant. However, they will continue to evolve through integration with emerging digital security technologies.