Fresh China rare earth trade talks have commenced in London as Beijing and Washington seek to maintain a fragile truce struck last month during negotiations in Geneva.

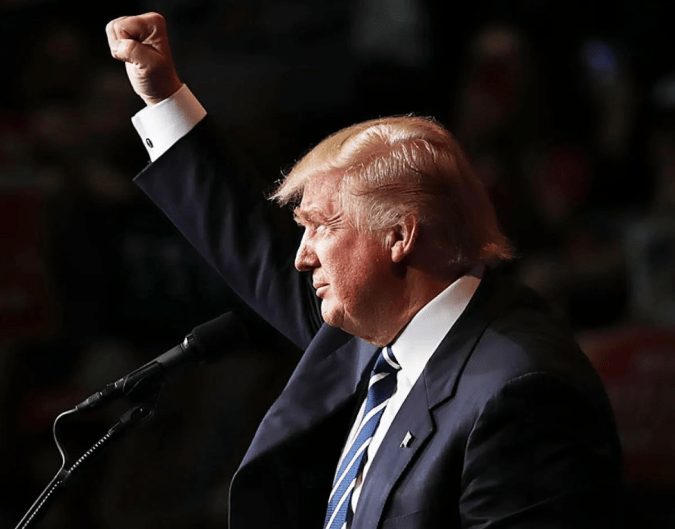

The talks follow a high-level phone call between US President Donald Trump and Chinese President Xi Jinping. The call helped revive diplomatic dialogue after tensions escalated over key trade issues, especially China’s control of rare earth minerals and access to US-made semiconductors.

Beijing’s near-monopoly over rare earth minerals has become the defining issue of this round of talks. These 17 critical elements are vital to modern technologies, powering everything from electric vehicles to advanced military systems.

“China’s control over rare earth supply has become a calibrated yet assertive tool for strategic influence,” wrote Robin Xing, Morgan Stanley’s chief China economist. “Its near-monopoly of the supply chain means rare earths will remain a significant bargaining chip in trade negotiations.”

Sources familiar with the matter confirmed that the U.S.-China trade discussions were already underway in London. China’s state news agency, Xinhua, also reported the launch of the session.

US officials, including Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer, are attending the talks. They will meet with China’s Vice Premier He Lifeng and his delegation.

The US is demanding a more consistent and open flow of rare earth exports. Speaking to CNBC, White House adviser Kevin Hassett said: “This was a very significant sticking point, because China controls… something like 90% of the rare earths and the magnets.

And if they’re slow rolling, sending those to us because of some licensing deal that they set up, then it could potentially disrupt production for some US companies that rely on those things.”

President Trump reportedly pressed Xi directly on the issue, urging immediate action to ease the restrictions.

Beijing has imposed a licensing regime on rare earth exports, requiring paperwork for each shipment. Though the move was introduced in April, the US expected this to be lifted following the Geneva truce. However, approvals have reportedly been slow, prompting fresh criticism from Washington.

On Saturday, China’s Commerce Ministry said it had “approved a certain number of compliant applications.”

“China is willing to further enhance communication and dialogue with relevant countries regarding export controls to facilitate compliant trade,” the spokesperson added.

Some American firms have reportedly secured temporary six-month export licences, including suppliers to major automakers such as General Motors and Ford.

Experts suggest China may be using its rare earth dominance to pressure the US into softening its own restrictions on semiconductor exports.

“Beijing had become more assertive in its use of export controls as tools to protect and cement its global position in strategic sectors, even before Trump hiked China tariffs this year,” noted a report by Capital Economics.

Rare earths may become Beijing’s strongest bargaining chip, especially as Washington tightens controls on chip technology bound for China.

Despite playing hardball in trade talks, China is battling economic turbulence at home. Latest customs data shows overseas exports grew by only 4.8% in May—a slowdown from April’s 8.1% growth. Exports to the US fell a sharp 34.5%, even after the May 12 trade truce, which reduced tariffs.

Spokesperson Lü Daliang remained upbeat, stating that China’s goods trade has shown “resilience in the face of external challenges.”

However, inflation data tells a different story. China’s Consumer Price Index (CPI) dropped 0.1% in May, while the Producer Price Index (PPI) fell by 3.3%—the steepest drop in nearly two years.

Chief NBS statistician Dong Lijuan blamed falling global oil and gas prices, as well as weak demand for coal and raw materials.