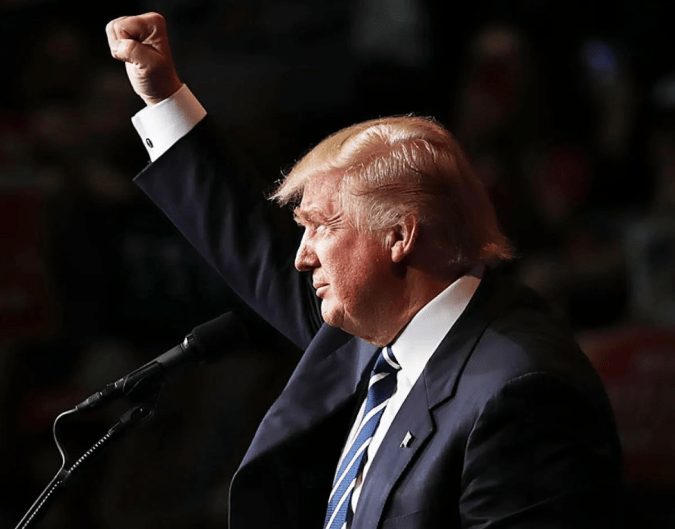

Trump’s tariffs may have intensified, but the market’s response? Lukewarm at best. Investors appear increasingly unfazed by former U.S. President Donald Trump’s trade threats, brushing off what once might have sparked global panic.

Asian markets closed in the green Thursday, drawing strength from chipmaker Nvidia’s fleeting $4 trillion valuation. European indices looked set to follow suit, despite Trump announcing a 50% tariff on U.S. copper imports and another 50% on Brazilian goods, effective August 1.

Some tremors were felt—copper prices dipped in London and China, and Brazil’s real weakened. Yet, wider market reactions were surprisingly muted.

Bitcoin hovered near record highs. The U.S. dollar dipped. Risk appetite stayed firm.

“Desensitised” and “numb” — those are the words being thrown around by analysts and fund managers. But how long can that last?

So far, Trump’s tariff storm hasn’t reached every shore. Many nations are still waiting for official word. Eyes are now on the EU. Trump hinted he’d “probably” reveal their tariff rate soon, but added the bloc had become “much more cooperative.”

EU trade commissioner Maros Sefcovic remained optimistic, stating: “Good progress had been made on a framework trade agreement and a deal may even be possible within days.”

Meanwhile, the U.S. President’s latest delay in enacting new tariffs offers some breathing room. Key trade allies like Japan, South Korea, and the EU see it as a window for potential deals. Others, including South Africa, remain in limbo—puzzled by Washington’s lack of clarity.

Still, the markets are holding steady. No mass sell-offs. No real jitters.

There’s a reason. Many are clinging to the belief in “TACO” — Trump Always Chickens Out. It’s a phrase now quietly doing the rounds on trading floors and in boardrooms alike.