NVIDIA has reported another blockbuster quarter, setting new financial records as demand for AI chips, GPUs, and large-scale data centre infrastructure continues to explode worldwide.

The company’s results for the third quarter of fiscal 2026 underline just how central NVIDIA has become to the global artificial intelligence race.

The tech giant posted a massive $57.0 billion in revenue, up 22% from last quarter and 62% higher than the same time last year, a level of growth rarely seen in a company of this size.

Its Data Centre division, which powers everything from cloud computing to AI model training, brought in an astonishing $51.2 billion, also an all-time high.

Profit margins remained remarkably strong, with NVIDIA reporting around 73% gross margin on both GAAP and non-GAAP bases.

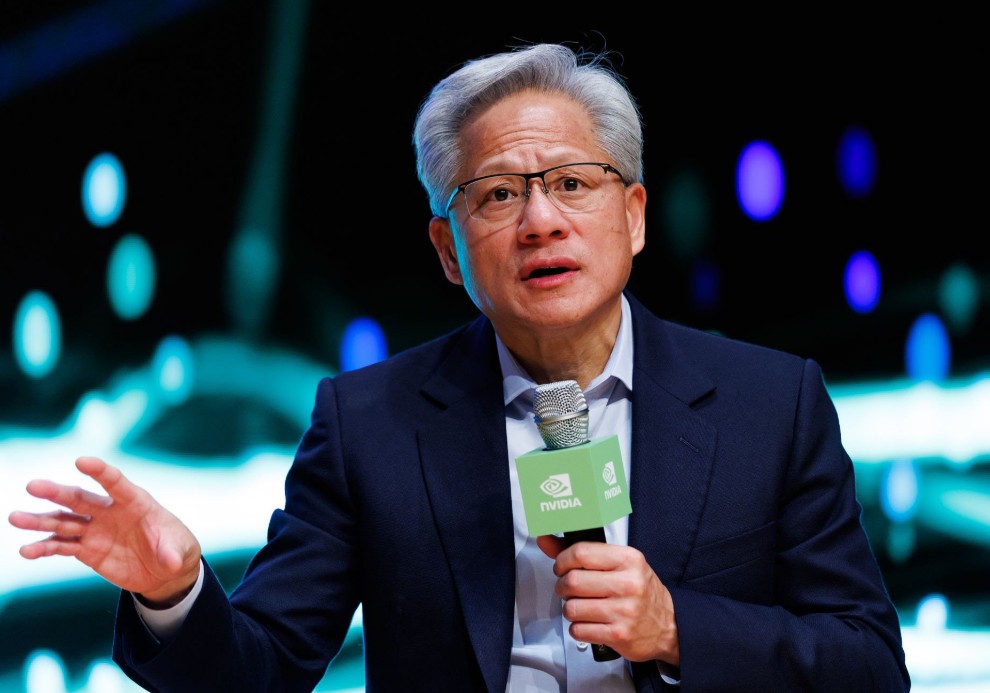

In a statement that captured the mood of the industry, founder and CEO Jensen Huang said: “Blackwell sales are off the charts, and cloud GPUs are sold out… We’ve entered the virtuous cycle of AI… AI is going everywhere, doing everything, all at once.”

AI Demand Drives Record-Breaking Revenue

Put simply, companies across the world can’t get AI hardware fast enough. From training massive language models to running everyday AI features, the appetite for processing power is rising at a pace the broader semiconductor industry has rarely witnessed.

Several huge partnerships helped fuel NVIDIA’s latest surge:

- OpenAI is set to deploy at least 10 gigawatts of NVIDIA systems for next-generation AI infrastructure.

- Microsoft, Google Cloud, Oracle, and xAI are all increasing their GPU capacity by hundreds of thousands of units.

- Anthropic is joining NVIDIA platforms at scale for the first time, beginning with a 1-gigawatt compute buildout.

- Intel and NVIDIA have announced a collaboration to develop future PC and data-centre platforms using NVLink.

- New AI investments are rolling out across the United Kingdom, Germany, South Korea, and the United States, including advanced supercomputers and artificial AI hookups.

One emblematic corner came as TSMC produced the first NVIDIA Blackwell wafer in Arizona, marking progress for US-grounded chip manufacturing.

Broader Business Lines Also Growing

While AI remains the star of the show, NVIDIA’s other segments are also quietly growing, helping the company maintain a diverse revenue base.

Gaming & AI PCs

- Gaming revenue hit $4.3 billion, roughly flat against last quarter but 30% up year-on-year.

- NVIDIA marked 25 years of GeForce in Seoul.

- New titles such as Battlefield 6 and Borderlands 4 launched with support for DLSS 4.

- The company is pushing AI-powered PC experiences, with RTX tools now enabling 3D object generation and enhanced Windows ML features.

- Professional Visualisation

- Revenue reached $760 million, a solid 26% climb over the previous quarter.

- NVIDIA began shipping DGX Spark, marketed as the world’s smallest AI supercomputer.

Automotive & Robotics

- The automotive segment generated $592 million, up 32% from last year as demand for autonomous driving tech grows.

- The new DRIVE AGX Hyperion 10 platform targets Level 4 autonomous vehicles.

- A new partnership with Uber aims to build a Level 4-ready mobility network by 2027.

- NVIDIA also expanded its robotics and industrial AI work with companies such as Toyota, Amazon Robotics, Foxconn, Caterpillar, and TSMC, integrating digital twins and physical AI systems.

Strong Cash Position and Shareholder Returns

NVIDIA has returned $37 billion to shareholders over the first nine months of fiscal 2026, mainly through share buybacks.

A quarterly dividend of $0.01 per share will be paid on 26 December 2025.

Despite heavy investment in AI infrastructure and manufacturing capacity, the company now holds $60.6 billion in cash and marketable securities, a robust reserve for future expansion.

$NVDA just printed one of the strongest quarters in tech history.

Total revenue: $57B (Data Center $51B)

Net income: $32B

Gross margins 73%.

Q4 guide $65B.Jensen: “Blackwell sales are off the charts.”

$500B+ demand visibility into 2026.All without any revenue from China.… pic.twitter.com/uvE3QCjo1o

— ValueHunter (@ValueHunter_net) November 20, 2025

NVIDIA expects the momentum to continue into the final quarter of fiscal 2026. The company is forecasting revenue of $65 billion, plus or minus 2%, driven almost entirely by demand for next-generation AI computing, GPUs, and cloud data centre expansion.

With AI sweeping through every major industry, from healthcare and robotics to finance, entertainment, and consumer tech, NVIDIA looks set to remain at the heart of the global push towards more powerful artificial intelligence.