Have you ever wondered what companies use V12 Retail Finance in the UK? In an age where flexible payment options are transforming the way we shop, V12 Retail Finance stands out as one of the leading providers. Whether you’re eyeing a new bike, upgrading your home furniture, or purchasing the latest tech, V12 allows you to pay for it over time, making large purchases more manageable.

This comprehensive guide will uncover which companies are using V12 Retail Finance in 2025, how it benefits both customers and businesses, and why it’s becoming a go-to option for shoppers across the UK. If you’re planning a big-ticket purchase, you’ll want to read this!

Why Are More UK Companies Turning to V12 Retail Finance in 2025?

The Changing Landscape of Consumer Finance

In 2025, UK consumers are becoming more accustomed to flexible and straightforward financing options. V12 Retail Finance provides a seamless, point-of-sale finance solution, enabling shoppers to buy what they need and pay for it in manageable monthly instalments.

Here’s why UK companies are embracing V12 Retail Finance:

- Frictionless Shopping Experience: Integrates smoothly with both online and in-store platforms.

- Instant Credit Decisions: Customers can apply and get instant approval, making the buying process faster.

- Customisable Plans: From 0% APR to longer-term repayment options, customers can choose a plan that works for them.

- FCA Regulated: V12’s approval from the Financial Conduct Authority ensures transparency and consumer protection.

- Higher Conversion Rates: Retailers see increased sales as a result of offering easy payment options.

What Companies Use V12 Retail Finance? The 2025 Top Players

Retailers Across Various Industries Are Onboard

Several prominent businesses across the UK collaborate with V12 Retail Finance to provide their customers with convenient and flexible financing solutions. These partnerships span various industries, from tech gadgets to luxury watches. Here’s a look at some of the most prominent companies using V12 Retail Finance:

| Company Name | Industry | Key Offerings | Availability (Online/In-Store) |

| Evans Cycles | Sports & Outdoor | Bikes, e-bikes, cycling accessories | Online & In-Store |

| DFS | Furniture | Sofas, beds, and home furniture | Online & In-Store |

| Vision Express | Eye Care | Designer glasses, contact lenses, and eye exams | In-Store |

| PC Specialist | Tech/Computing | Custom-built PCs, gaming laptops | Online |

| Richer sounds | Electronics & Audio | Televisions, home cinema systems, and audio equipment | Online & In-Store |

| The Electric Bike Shop | Electric Vehicles | E-bikes, electric scooters, and accessories | Online & In-Store |

| Reidy’s Home of Music | Music Instruments | Guitars, pianos, drums, and amplifiers | Online |

| Watch pilot | Luxury Watches | Watches from brands like Seiko, Citizen, Garmin | Online |

| Home Living Luxury | Home & Lifestyle | Luxury home furnishings, sofas, beds | Online |

| Cycle Solutions | Bikes & Accessories | Mountain bikes, commuter bikes, cycling gear | Online |

Note: This list is up-to-date as of April 2025 and reflects the diverse range of sectors embracing V12 Retail Finance. The list of partners is continually expanding, making financing options more widely available.

How Can You Use V12 Retail Finance for Your Purchases?

Simple Steps to Secure Your Purchase Through V12 Finance

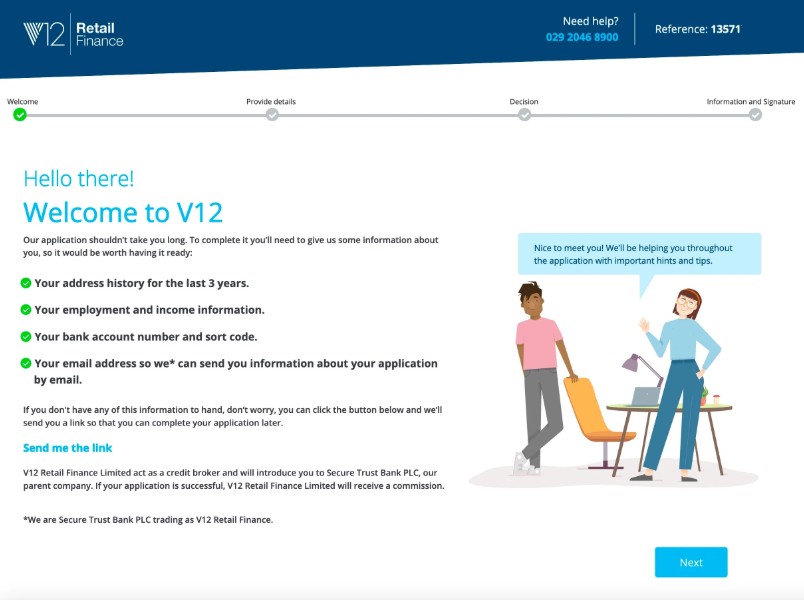

Using V12 Retail Finance is incredibly straightforward. Here’s a step-by-step guide to help you understand the process:

- Select Your Desired Product – Visit a retailer that offers V12 Retail Finance, like DFS or Evans Cycles.

- Choose V12 Finance at Checkout – Opt for V12 Finance as your preferred payment method when finalising your purchase at checkout.

- Apply for Credit – Fill out a short application form (usually takes 5-10 minutes).

- Receive Instant Decision – You’ll get an immediate response on whether you’re approved.

- Sign the Agreement – If approved, you can digitally sign your finance agreement.

- Enjoy Your Purchase – Your product will be shipped to you after the finance is confirmed, and you can start paying in instalments.

What Are the Key Eligibility Requirements for V12 Retail Finance?

Is It Easy to Get Approved?

The eligibility for V12 Retail Finance is designed to be simple and accessible. Still, certain essential criteria must be met.

- Minimum Age Requirement: Applicants must be at least 18 years old.

- Residency Status: You should hold permanent residency status in the UK.

- Income: A stable income is required.

- Bank Account: A UK bank account and debit card are necessary.

- Credit History: While the service offers flexible options, a clean credit history is often preferred, although some retailers may approve with a lower score.

Quick Tip: Always check your credit score before applying. It could speed up the process and give you a better idea of your chances for approval.

Is V12 Retail Finance Safe and Secure?

Trustworthy and Regulated

One of the main concerns with financing is security. V12 Retail Finance addresses this by being fully regulated by the Financial Conduct Authority (FCA). This regulation ensures that the financial agreements offered through V12 are fair, transparent, and legally binding.

Key Safety Features of V12 Retail Finance:

- Data Encryption: Your personal and financial data is securely encrypted.

- Regulation: All finance offers are subject to stringent UK laws, giving you peace of mind.

- Clear Terms: All finance terms are clearly outlined, so you know what to expect.

Final Thoughts: The Growing Role of V12 Retail Finance in UK Retail

Knowing what companies use V12 Retail Finance can help UK shoppers make smarter purchasing decisions. Whether you’re investing in tech, furniture, or even a luxury watch, having flexible financing options available makes it easier to spread the cost over time.

As we move further into 2025, more and more UK retailers are embracing flexible payment options like V12, so be sure to check out whether your favourite stores offer this financing solution. It could make your next big purchase a lot more affordable!

FAQs About V12 Retail Finance

Can I use V12 Retail Finance for online purchases?

Yes, many online retailers like PC Specialist and Watch Pilot offer V12 Retail Finance directly through their websites.

Is there a minimum spend for using V12 Finance?

Typically, the minimum spend is £250, but this can vary depending on the retailer.

Can I pay off my finance early?

Yes, V12 allows early repayment with no penalties. If you have the means to pay it off sooner, it could help reduce interest charges and improve your credit score.