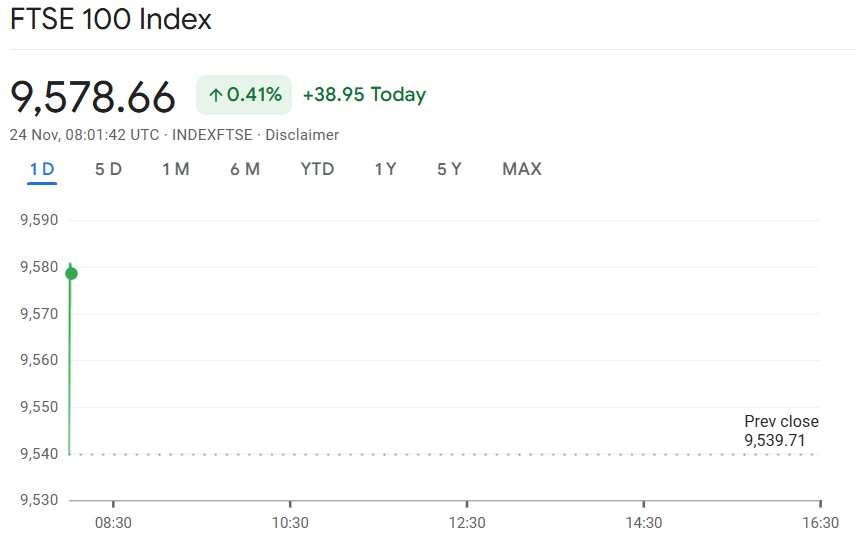

The FTSE 100 looks set to open higher this week, with futures pointing to a rise of 47 points to 9,578 on Monday. Investor sentiment has lifted following positive signals from global requests, suggesting a calmer launch after a week of volatility.

Global Markets Lift UK Shares

Traders were encouraged after John Williams, president of the New York Federal Reserve, indicated that a US interest rate cut remains possible before the end of the year.

Williams said that “a softening labour market now poses a bigger risk to the US economy than inflation,” marking a subtle but important shift in tone.

This has prompted futures markets to price in a 70% chance of a quarter-point rate cut at the Fed’s final meeting of 2025 in December, up from just 44% a week ago.

Across Asia, markets responded well to the news. Hong Kong’s Hang Seng jumped nearly 2%, led by strong gains in technology and healthcare stocks. Investors appear willing to take on more risk again, reversing last week’s tech-driven losses.

FTSE 100 Futures Respond to US Interest Rate Signals

Back in the US, Wall Street ended last week on a strong note. The Dow Jones climbed 1.08%, the S&P 500 added 0.98%, and the Nasdaq rose 0.88%, helping to stabilise investor confidence after recent swings.

In the London request, attention will turn to commercial developments, particularly BHP’s aborted preemption shot for Anglo American, which could dominate captions as trading begins.

For UK investors and those tracking the FTSE 100 indicator, the combination of Fed signals and calmer request conditions suggests a slightly more auspicious launch to the week.

Judges advise, still, that requests could remain sensitive to profitable data and commercial news.

The positive mood in global equities, paired with implicit financial easing in the US, means UK shares may profit, at least in the short term. Dealers are keeping a close eye on how both domestic and transnational factors shape request performance.