London shares are set for a bright launch on Wednesday as investors gear up for Chancellor Rachel Reeves’ Budget statement at 12.30 pm.

Request sentiment has been buoyed by expedients of new measures aimed at supporting growth and restoring confidence in the UK’s frugality.

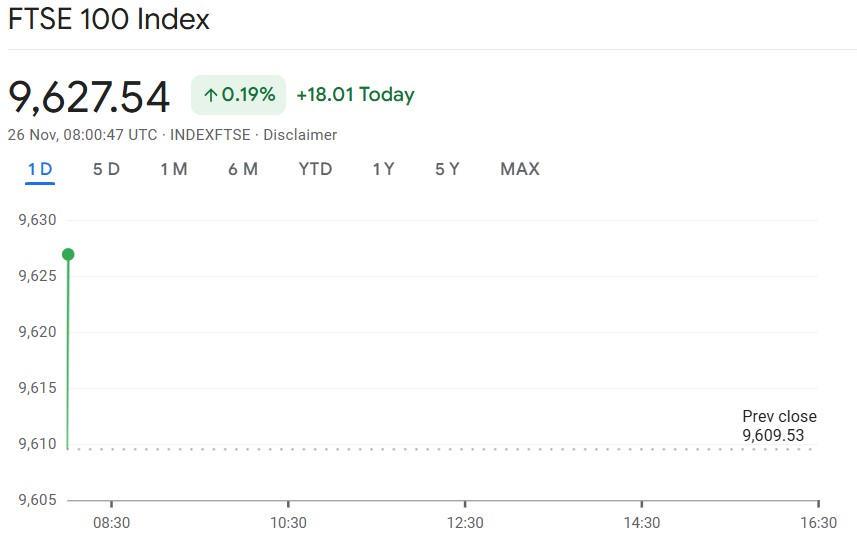

FTSE 100 Set to Rise

Futures indicate the FTSE 100 could climb by around 32 points, following Tuesday’s solid advance of 74.62 points, which pushed the indicator to 9,609.53.

Dealers are keeping a close eye on implicit government enterprise to boost investment and consumer confidence, which could give London’s equity requests an important demand lift.

UK Stock Market Momentum

Wall Street’s overnight rally provided a helpful push for London investors. After a slow start, US markets surged, with the Dow Jones gaining 664 points (1.4%) to 47,112.

The S&P 500 rose 0.9% to 6,766, while the Nasdaq added 0.7% to 23,026. All three indicators have now returned to the record highs seen before this month, signaling a renewed sense of sanguinity among global investors.

The upbeat mood has spread to Asia as well. India’s Sensex led earnings with a 1% rise, Hong Kong’s Hang Seng rose 0.4%, and Japan’s Nikkei floated just above flat, reflecting steady but conservative confidence in global requests.

With transnational equities back in rally mode, all eyes are now on Westminster. moment’s Budget could set the tone for the FTSE 100 and wider UK stock market for the months ahead.

Judges suggest that any clear measures to support business growth, attack affectation, or incentivise investment could boost request confidence and encourage further trading efforts on London’s main board.

In short, investors are hoping the Chancellor delivers a Budget that not only reassures the City but also keeps the UK forcefully on the path of profitable recovery, ensuring the FTSE 100 remains in a strong position throughout the time.