Premium Bond Prizes: Over £100 Million Still Unclaimed by UK Savers

Over £103 million in premium bond prizes remains unclaimed across the country, with more than 2.5 million wins still sitting idle.

Among them are 11 untouched £100,000 prizes, a sharp reminder that thousands of bondholders may have no idea they’ve struck lucky.

National Savings and Investments (NS&I), the government-owned body that runs the Premium Bonds scheme, is facing increasing criticism for not doing enough to reunite winners with their prizes.

While NS&I says it has paid out over 99% of winnings since the scheme began in 1957, many say that’s not good enough.

“Shockingly, a government-owned bank is sitting on nearly £100m [in unclaimed prizes] that doesn’t belong to it during a cost of living crisis,” said Patrice Lawrence, a wills and probate solicitor who’s helped multiple families trace lost bonds.

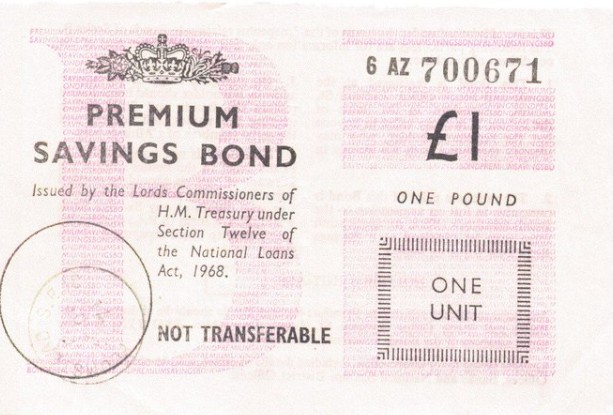

The Premium Bonds scheme is unique. It’s a savings account, but instead of earning interest, your money is entered into a monthly prize draw. The prizes range from £25 all the way up to £1 million.

Every bond has a chance. But not everyone remembers they’re even holding one.

Some customers move and forget to update their details. Others never received physical certificates. Many had bonds gifted to them as children and never knew.

The very first prize draw took place in June 1957. Since then, ERNIE, short for Electronic Random Number Indicator Equipment, has selected more than 772 million winning numbers, worth a combined £37 billion. Yet a small fraction of those remain lost in the system.

Melanie Clarke knows the struggle. While sorting through her late father Hugo’s belongings, she discovered old Premium Bond documents.

“They’re quite delicate and flimsy… [I thought of the papers] What part of that is important? How do I find out any information about this?” she explained.

Her father, who came to Britain from Trinidad as part of the Windrush generation, passed away without a will. Melanie is now caught in a drawn-out process with NS&I to retrieve what might still be left in the accounts.

NS&I’s retail director, Andrew Westhead, admits it’s not always straightforward. “The £103m of prizes currently unclaimed represents just 0.28% of the total £37bn awarded by ERNIE over nearly seven decades,” he said.

He noted that many bonds purchased before NS&I’s digital overhaul are significantly harder to track.

Nearly 23 million people currently hold Premium Bonds in the UK, with a combined value of £130 billion. Yet many, like Melanie, have no idea what’s been left behind.

Consumer experts say that’s unacceptable. Iona Bain, resident money expert on BBC’s Morning Live, said the bank’s tracing process feels outdated and robotic.

“In theory, it shouldn’t be the end of the world if you don’t have the original certificate… But the reality is more complicated,” she said. “Too many people have been left unhappy with what they feel is a ‘computer says no’ approach.”

Some customers report finding certificates with clear details, bond number, date, location of purchase, only to be told they aren’t enough to verify ownership.

Patrice Lawrence has now started a petition calling for change. She believes basic information like name, date of birth, and original address should be sufficient to recover accounts.

She’s also highlighted other key issues: families discovering paperwork years after a loved one’s death; adults unaware that childhood bonds must be formally transferred at age 16; and NS&I’s reluctance to give clarity on who bond records belong to.

Sam Richardson from Which? has criticised NS&I’s lack of integration with government schemes like Tell Us Once and the Death Notification Service, both of which simplify the process of managing a deceased person’s affairs.

NS&I says it needs to deal with executors directly, which requires more “individualised contact.” But many argue that it shouldn’t prevent the bank from adopting a more user-friendly approach.

For those looking to trace bonds, NS&I does offer a few solutions. People can use its online prize checker or tracing service.

MyLostAccount, a tool backed by UK Finance and the Building Societies Association, is also available. Alternatively, bondholders can call the NS&I helpline on 08085 007 007.

Those without bond numbers aren’t out of luck, NS&I says you can still apply using personal details, or by providing proof of authority if acting on someone else’s behalf.

The bigger issue, though, remains clear: millions of pounds in premium bond prizes are sitting idle, and too many people have no idea they’ve won.

With a cost-of-living crisis affecting households up and down the UK, campaigners say it’s time for NS&I to act, and help people get back the money that’s rightfully theirs.