For many UK citizens over the age of 70, travel represents a rewarding chapter in life—one filled with relaxation, adventure, and treasured memories. However, travelling at this age also comes with added risks, especially for individuals managing pre-existing medical conditions. That’s where having the right travel insurance makes all the difference.

In this blog post, we’ll walk you through everything you need to know about what is the best travel insurance for over 70 with medical conditions, how the UK insurance market is responding to this demographic, and how to choose a plan that truly offers peace of mind without breaking the bank.

Why Is Travel Insurance So Important After 70?

Real Risks, Real Needs

It’s no secret that as we age, we become more vulnerable to sudden health complications. For travellers over 70, particularly those with chronic or acute medical issues, the potential cost of medical emergencies abroad can skyrocket. Here’s why the right travel insurance is essential:

- Hospitalisation abroad may cost thousands of pounds

- NHS coverage is not valid beyond the borders of the United Kingdom.

- Pre-existing conditions may be excluded in standard policies

- Without insurance, emergency repatriation can be financially devastating

A comprehensive insurance policy doesn’t just protect your wallet—it protects your health, security, and travel experience.

Why Do Over-70s Need a Different Kind of Travel Insurance?

Significant Medical Care Needs:

Overseas emergency treatment can incur substantial costs that often exceed NHS provisions.

Heightened Risk of Trip Cancellation:

Chronic health conditions or sudden illnesses may force you to cancel or interrupt your travel plans.

Potential for Repatriation:

In the event of an emergency, a comprehensive policy can cover the costs of transporting you back to the UK.

Assistance for Mobility-Related Issues:

Policies tailored for older travellers often include coverage for mobility aids and related assistance.

What Is the Best Travel Insurance for Over 70 With Medical Conditions?

Comparing Today’s Top UK Providers (2025 Edition)

Finding suitable travel insurance when you’re over 70 and managing pre-existing medical conditions can be challenging, but it’s not impossible. Many insurers have now adapted their policies to cater specifically to older travellers who need extra medical cover while travelling.

Below is a breakdown of six of the top travel insurance providers in the UK, including what makes each one suitable for seniors with health conditions.

1. Staysure

-

Pre-Existing Conditions: Covers 1,300+ conditions, including heart disease, diabetes, cancer, and more.

-

Age Limit: No upper age limit (they offer custom quotes for all age groups).

-

Estimated Premium: £65 to £190 per trip.

-

Key Features:

-

Unlimited medical expense cover on comprehensive plans.

-

Free cover for COVID-19-related medical claims.

-

Very popular for older travellers, with flexible policies tailored to individual needs.

-

Why choose Staysure?

If you’re over 70 and want peace of mind with a wide range of medical conditions covered—Staysure is one of the most inclusive and senior-friendly providers.

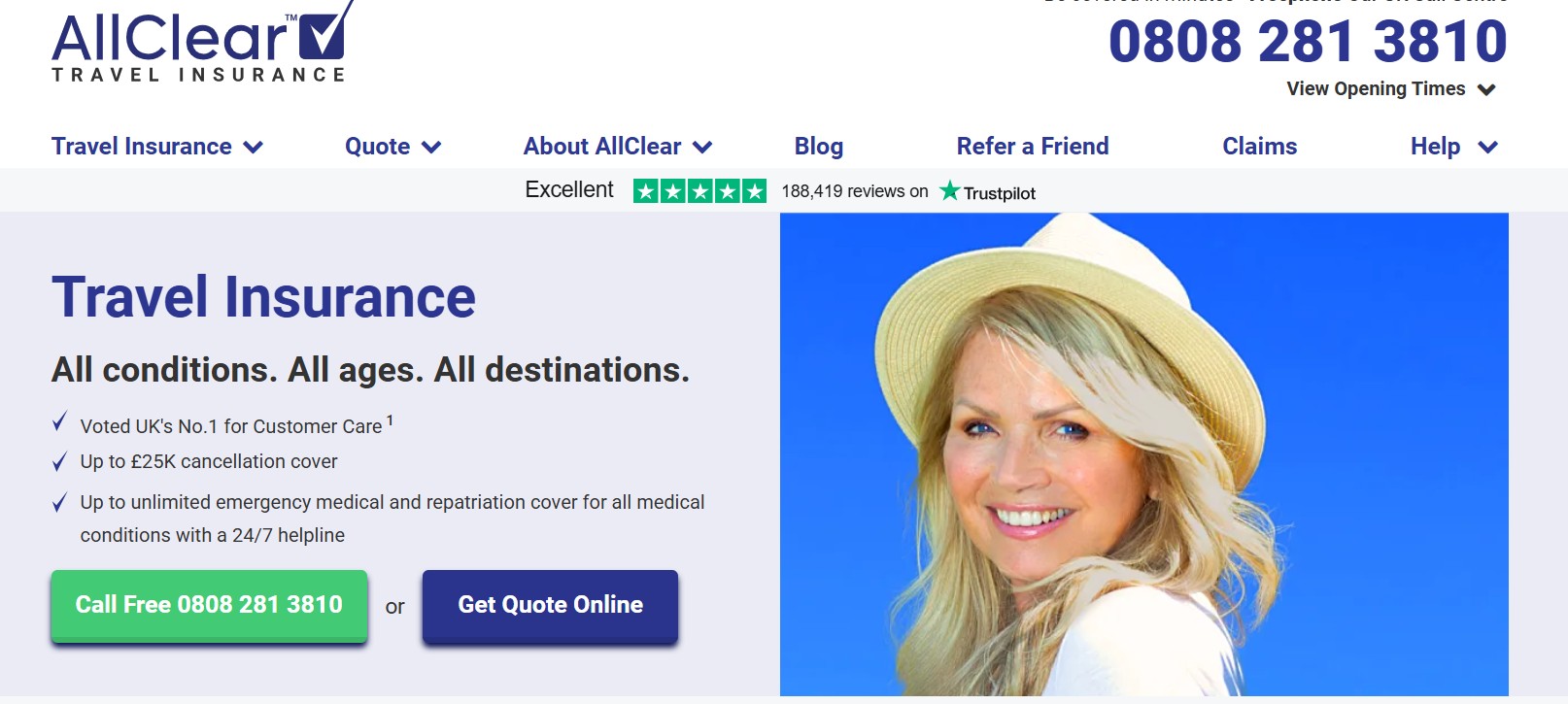

2. AllClear Travel

-

Pre-Existing Conditions: Covers complex chronic and even terminal conditions.

-

Age Limit: No age limit at all.

-

Estimated Premium: £80 to £220 per trip.

-

Key Features:

-

Known for comprehensive medical screening.

-

Often recommended for travellers with multiple or more serious health concerns.

-

Offers both single-trip and annual multi-trip options.

-

Why choose AllClear?

It’s ideal for travellers who may struggle to get insured elsewhere due to multiple or high-risk health issues.

3. Saga

-

Pre-Existing Conditions: Tailored medical screening allows for accurate assessments.

-

Age Limit: Up to 120 years old, with flexibility in certain cases.

-

Estimated Premium: £60 to £180 per trip.

-

Key Features:

-

Travel cancellation and curtailment included.

-

Designed exclusively for over-50s.

-

Offers optional upgrades and cruise-specific coverage.

-

Why choose Saga?

Saga is a trusted brand among senior travellers and provides a well-rounded policy for those over 70 with manageable medical conditions.

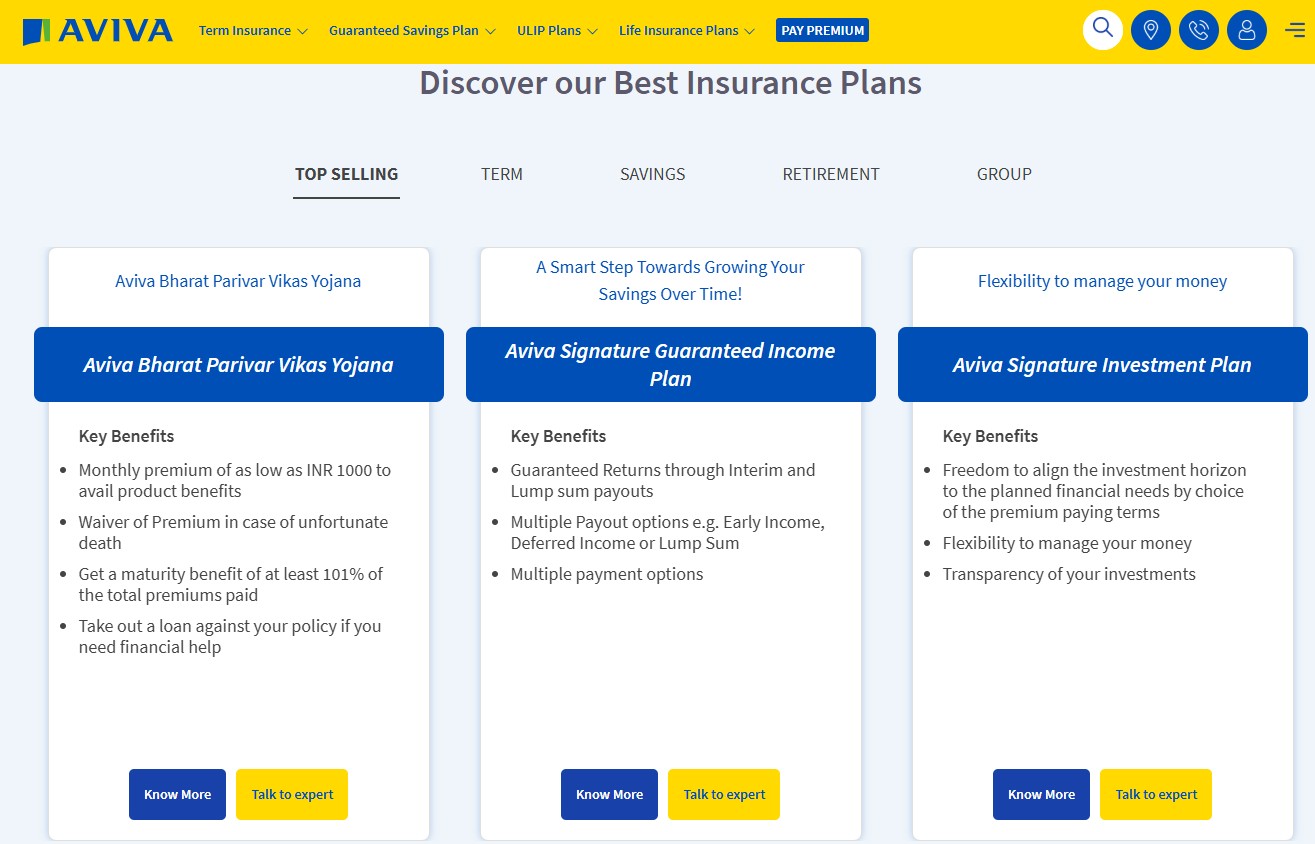

4. Aviva

-

Pre-Existing Conditions: Assessed individually on a case-by-case basis.

-

Age Limit: Policies start limiting after 70, but extensions are often available.

-

Estimated Premium: £70 to £200 per trip.

-

Key Features:

-

Excellent global hospital networks.

-

24/7 international assistance services.

-

Competitive pricing for comprehensive travel cover.

-

Why choose Aviva?

Aviva is a strong choice for those who prefer a larger, mainstream insurer that still provides solid medical coverage and support abroad.

5. Age Co (via Age UK)

-

Pre-Existing Conditions: Covers a wide range of moderate to serious medical issues.

-

Age Limit: Starts at 70+ with accessible plans.

-

Estimated Premium: £50 to £150 per trip.

-

Key Features:

-

Operated in partnership with Age UK, specifically for older adults.

-

Optional add-ons for more adventurous travel or higher-risk conditions.

-

Strong focus on accessibility and customer support.

-

Why choose Age Co?

If you’re looking for a policy that’s tailored to your stage in life, with backing from a trusted name like Age UK, this could be a great fit.

6. Goodtogoinsurance.com

-

Pre-Existing Conditions: Willing to cover very high-risk medical conditions.

-

Age Limit: No upper age cap.

-

Estimated Premium: £75 to £210 per trip.

-

Key Features:

-

Covers up to £10 million in medical expenses.

-

Easy online medical screening process.

-

Excellent for those turned away by other insurers.

-

Why choose Goodtogoinsurance.com?

It’s a specialist insurer for seniors and people with significant medical histories who may not qualify for standard travel policies.

What Should You Look for in the Best Travel Insurance for Over-70s?

- Comprehensive Emergency Medical Coverage:

Ensure the policy offers high limits (e.g., up to £10 million) for emergency treatment abroad. - 24/7 Support Services:

Look for insurance plans that provide continuous access to a dedicated medical assistance helpline. - Repatriation and Evacuation Benefits:

Confirm that repatriation costs are fully covered and that urgent evacuations are managed smoothly. - Trip Cancellation & Curtailment Protection:

Choose policies that refund your trip costs if you have to cancel or cut short your journey due to health emergencies.

Optional Extras Worth Considering

- Mobility Aid Coverage:

Includes reimbursement for essential equipment such as wheelchairs and walking aids.

- Cruise and Sea Travel Enhancements:

Offers additional benefits for travellers planning extended sea or cruise vacations. - Companion or Carer Protection:

Provides support if you travel with a companion or require a caregiver during your journey. - Pre-Trip Medical Flexibility:

Covers circumstances where you need to cancel your trip due to a sudden change in your medical condition. - Upgrades to Private Hospital Treatments:

Optional add-ons may allow faster, more personalised treatment abroad.

What is are difference between Single-Trip and Annual Multi-Trip Cover?

- Single-Trip Insurance:

- Ideal for Infrequent Journeys: Designed for those who travel only once or rarely within a year.

- Simplicity: Offers straightforward coverage for a specific trip with no ongoing commitments.

- Annual Multi-Trip Insurance:

- Economical for Frequent Travellers: Provides comprehensive coverage for multiple trips, streamlining your travel planning.

- Flexible Use: Although there may be a maximum trip duration per journey, the annual cover tends to be more cost-effective over time.

Real Stories from UK Travellers Over 70

Experiences That Show the Value of Being Insured

Margaret, 74, from Bristol

I went to Italy with my granddaughter. I have COPD and was nervous about the flight. My Stay Sure insurance plan provided coverage for medical oxygen and emergency evacuation services. I ended up needing a hospital visit, and everything was handled so smoothly.

David, 77, from Leeds

All Clear was a bit more expensive than others, but they didn’t flinch when I declared prostate cancer. I had to cancel the trip after a medical update—got a 100% refund within 10 days.

Final Decision-Making: A Quick Recap

- Declare All Health Information Accurately:

Full disclosure avoids the risk of claim denials and ensures smooth coverage. - Select Policies Tailored for Senior Needs:

Opt for insurers with strong reputations in supporting travellers over 70. - Read Policy Details Thoroughly:

Familiarise yourself with both inclusions and exclusions to avoid any surprises. - Compare Multiple Quotes:

Utilize trusted UK comparison tools to balance cost with the quality of cover.

FAQs – All Your Questions Answered

Can I still get travel insurance at age 85+?

Yes, several UK providers like All Clear, Good to Go insurance, and Saga have no upper age limit.

Will I be covered if my condition worsens during the trip?

If the condition was declared and covered, yes. But if it changes or worsens after purchase and you don’t update your insurer, it may not be covered.

How long does the medical screening process take?

Usually 10–20 minutes. It’s worth the time to avoid any complications during a claim.

Are there cheaper policies that still offer solid coverage?

Yes, but always compare features, not just prices. The cheapest plans often come with high excess or key exclusions.

Do I need travel insurance for trips within the UK?

While the NHS covers health, insurance helps with cancellations, luggage loss, and travel disruption even within the UK.