Savers with Premium Bonds may need to rethink their strategy. NS&I has introduced new rates across its range of British Savings Bonds, including the fixed-term Guaranteed Growth Bonds and Guaranteed Income Bonds.

The move comes with higher returns, prompting questions over whether the Premium Bonds prize fund rate might follow suit.

NS&I has trimmed the Premium Bonds prize rate multiple times this year, in January, April, and August. The current rate now stands at 3.6 per cent. Odds of winning per £1 Bond remain at 22,000 to one.

Sarah Coles, head of personal finance at Hargreaves Lansdown, voiced scepticism about a price rate increase.

She said: “When NS&I is in fund-raising mode, you can’t rule out a Premium Bond prize rate rise, but it doesn’t seem enormously likely.

This change is designed to attract people looking for fixed-term deals. It’s only if this falls short of expectations that NS&I might look elsewhere.”

A slow decline in rates

Coles believes the price rate is more likely to keep slipping. She explained: “The wider picture is one of very gradually falling rates, so assuming NS&I doesn’t need to pull the emergency lever, there’s every chance that the next move for the Premium Bond prize is a cut in the coming months.”

Yet, she cautioned that another reduction may not deter investors. Many bondholders continue to hold their stakes, despite slim chances of winning big.

She added: “Even now, the average bondholder will win nothing in the average month. It means your savings are likely to lose money after inflation.”

She encouraged savers to review their portfolios regularly. “It’s always worth taking stock regularly, and considering whether you’re still happy with the deal, or whether you’d prefer the certainty of a strong rate in the wider savings market.

Check what’s available from online banks and saving platforms, where you’ll usually find the strongest deals.”

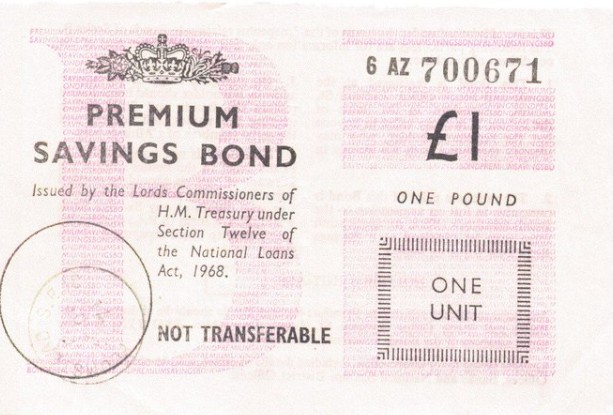

How do Premium Bonds work?

Every £1 Bond entered into the monthly draw has an equal chance of winning a prize. Awards range from £25 to the £1 million top prize. Each draw always includes two £1 million jackpots.

Savers can opt to automatically reinvest any winnings into more Bonds, boosting their chances of future wins.

For those watching the NS&I interest rates closely, this development may shift how UK savers approach their portfolios in the coming months.