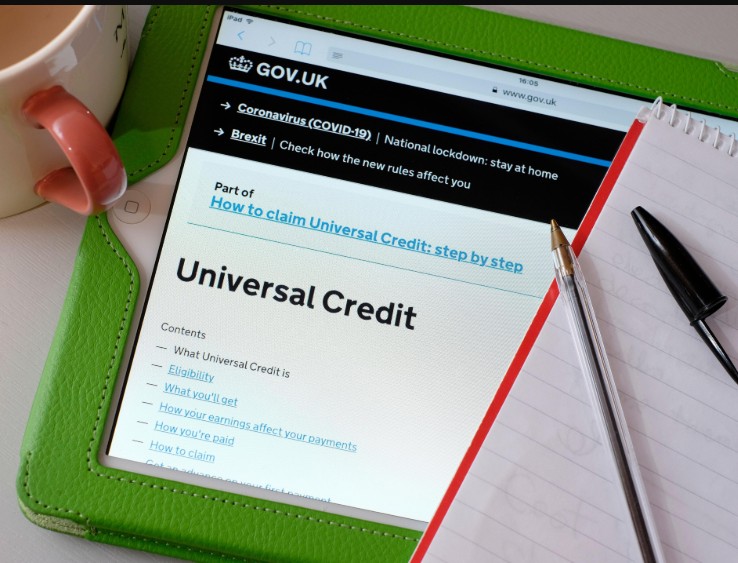

If you’re looking to gain in-depth insights on how to apply for a Budgeting Advance Universal Credit, you’re in the right place. This guide is crafted specifically for UK residents facing financial challenges, providing step-by-step instructions, important eligibility criteria, practical tips, and detailed insights into the process. With a focus on clarity and utility, the following article expands on every aspect of securing a budgeting advance and managing your finances effectively.

What is a Budgeting Advance Universal Credit?

A Budgeting Advance is a short-term, interest-free loan designed to support individuals receiving Universal Credit in covering immediate expenses. It is not meant to be a long-term solution but rather an emergency financial buffer to help bridge the gap between monthly payments and unexpected costs. The system is built around simplicity and ease, ensuring that UK residents can access essential funds promptly without the complexities of a traditional credit check.

Core Elements:

- Emergency Financial Support: An easily accessible loan for urgent needs.

- Integrated Repayment: Amounts are repaid automatically via future Universal Credit payments.

- No Impact on Credit Score: Designed to assist rather than penalize, with no hard credit checks.

- Focused on Necessity: Strict eligibility criteria ensure that only those genuinely in need receive support.

How to Apply for a Budgeting Advance Universal Credit?

Understanding the process is key to ensuring your application goes smoothly. Let’s explore each step in detail to gain a clearer understanding.

Step 1: Assess Your Financial Situation

- Evaluate Urgent Needs: Identify which expenses are immediately necessary. This might include unexpected bills, essential household items, or costs that arise from emergencies.

- Review Your Budget: Sit down and list your income versus your expenses to determine the specific shortfall.

- Consider Alternatives: Look at other possible support mechanisms like local council assistance or budgeting advice before applying.

Step 2: Prepare Your Documentation

- Ensure you are fully informed about the status of your current Universal Credit claim.

- Income and Expense Records: Gather information on your income, regular outgoings, and any proof of unforeseen costs.

- Supporting Evidence: This could be bills, repair cost estimates, or proof of urgent purchases.

Step 3: Initiate the Application

- Log in to your Universal Credit Account: Access your account online to locate the Budgeting Advance section.

- Fill out the Application Form: Provide your details, financial breakdown, and the specific amount you need.

- Clarify the Need: Clearly describe why the advance is essential for your current situation.

Step 4: Processing and Review by DWP

- Assessment: The Department for Work and Pensions (DWP) will review your submission, comparing your stated need against the available documentation.

- Decision: You will receive confirmation if your application has been accepted, or you might be asked for further clarification.

Step 5: Receiving Funds and Repayment

- Funds Disbursement: Approved funds will usually be credited directly within a few weeks.

- Automatic Deduction: Future Universal Credit payments will have a deduction reflecting the repaid amount.

Table: Comprehensive Process Overview

| Process Stage | Action | Details and Expected Outcome |

| Financial Assessment | Review the budget and identify urgent needs | Decide if a Budgeting Advance is necessary by listing essential expenses against available income. |

| Document Collection | Gather necessary paperwork and evidence | Organize proof of expenses, income records, and current Universal Credit claim details. |

| Application Submission | Complete online application form | Access your Universal Credit account, fill out the form accurately, and detail your financial predicament. |

| DWP Review | Wait for application processing | DWP verifies your eligibility and need; additional information may be requested |

| Fund Disbursement | Funds are credited if approved | Money is received within weeks; repayments are integrated with subsequent Universal Credit payments. |

How Can a Budgeting Advance Impact Your Daily Life?

Have you ever wondered, “How can a Budgeting Advance impact my daily financial routine?” This critical question is at the heart of understanding the benefits and potential challenges of this support:

- Immediate Relief: Provides urgent cash flow, ensuring that daily living expenses are met during financial shortfalls.

- Budget Smoothing: Helps in managing irregular income by providing a buffer against unexpected costs.

- Repayment Considerations: Although the advance is easily repaid through future deductions, it’s essential to plan your budget accordingly to avoid further shortfalls.

- Empowerment Through Planning: Encourages regular budget reviews and financial management, equipping you to better handle economic fluctuations.

Who can qualify for a Budgeting Advance under Universal Credit?

Before initiating your application, ensure that you meet the following criteria:

- Active Universal Credit Claimant: You must be receiving Universal Credit to qualify.

- Demonstrated Financial Need: Evidence of an immediate shortfall or unforeseen expense is necessary.

- Adherence to Set Limits: Advances are subject to specific caps that vary depending on your circumstances and local DWP guidelines.

Additional Eligibility Considerations:

- Recent Application: If you have previously taken out a Budgeting Advance, you might have to wait a certain period before reapplying.

- Supporting Documentation: Strong documentation enhances your application’s credibility.

Quick Facts and Figures:

| Eligibility Factor | Requirement | Implications |

| Claim Status | Must be an active Universal Credit recipient | Fundamental eligibility criterion |

| Financial Documentation | Proof of shortfall, such as bills or unexpected expenses | Determines the urgency and necessity of the advance |

| Advance Limits | Governed by DWP regulations and subject to budget caps | Ensures responsible lending and repayment |

| Frequency of Request | Limits on successive applications | Prevents overreliance on the system |

Expert Insights: Managing Repayments and Future Budgeting

Long-Term Financial Management: What Should You Keep in Mind?

Although a Budgeting Advance offers a short-term remedy, it is important to integrate this support into a broader financial strategy. Consider these expert tips:

- Review Your Spending: Use this opportunity to reassess your spending habits and adjust your monthly budgets.

- Plan for Future Needs: Keep an emergency savings fund to avoid future reliance on advances.

- Consult Budgeting Advice: Many local councils and community centers offer free financial counselling.

How to Stay Financially Resilient?

- Set Up Automatic Savings: Allocate small amounts from each payment towards a savings buffer.

- Monitor Repayment Impact: Regularly check your Universal Credit statements to ensure that repayments align with your expected budget adjustments.

- Seek Advice When Necessary: If the repayment process becomes challenging, reach out to financial advisors or your local Jobcentre Plus for support.

In-Depth Analysis: The Broader Impact on UK Households

Current Economic Environment and Its Effects

The fluctuating economic landscape in the UK makes budgeting and planning more critical than ever. A significant number of households are experiencing variations in income, increasing the appeal of flexible financial tools like the Budgeting Advance. The current trends suggest:

- Increased Demand for Short-Term Loans: More applicants are exploring this option due to rising living costs.

- Governmental Reviews: Recent evaluations by local authorities aim to improve the application process, ensuring that funds are allocated efficiently to those most in need.

- Community Initiatives: Alongside government support, numerous community organizations offer additional financial advice and resources.

Table: How Economic Trends Influence Budgeting Advances?

| Economic Trend | Impact on Households | Role of Budgeting Advances |

| Rising living costs | Increased pressure on monthly budgets | Provides relief for unexpected cost hikes |

| Fluctuating employment income | Greater financial instability | Acts as a buffer during periods of reduced income |

| Enhanced digital services | More streamlined and quicker application processes | Eases access through online platforms |

| Government policy reviews | Adjustments to eligibility and repayment processes | Aims to tailor advances to current economic realities |

Final Thoughts and Practical Tips

Securing a Budgeting Advance when you need it can be a crucial part of managing your finances in uncertain times. Here’s a quick recap:

- Stay Informed: Regularly check for updates on the Universal Credit guidelines.

- Be Prepared: Keep a record of all your financial documents organized for a smoother application process.

- Seek Expert Advice: Use free resources provided by Jobcentre Plus and community financial advisers.

- Plan Ahead: Integrate this temporary support into a wider, sustainable financial plan to safeguard against future emergencies.

By understanding how to apply for a Budgeting Advance Universal Credit in detail, you equip yourself with the knowledge necessary to navigate the process confidently. This guide provides you with a roadmap, from assessing your financial needs to managing repayments and planning for a stable financial future.

FAQs About How to Apply for a Budgeting Advance Universal Credit?

What is the maximum amount I can request?

The maximum amount is determined by the DWP based on your personal financial situation. It is advisable to check the most current guidelines on the official Universal Credit website or speak directly to a Jobcentre Plus advisor.

How quickly will I receive my funds after approval?

Once approved, the funds are usually released within a few weeks. Processing times may vary depending on the volume of applications and administrative reviews.

Are there any fees or interest charges associated with the advance?

There are no fees or interest charges for a Budgeting Advance. It is designed solely to assist with immediate financial needs without additional cost burdens.