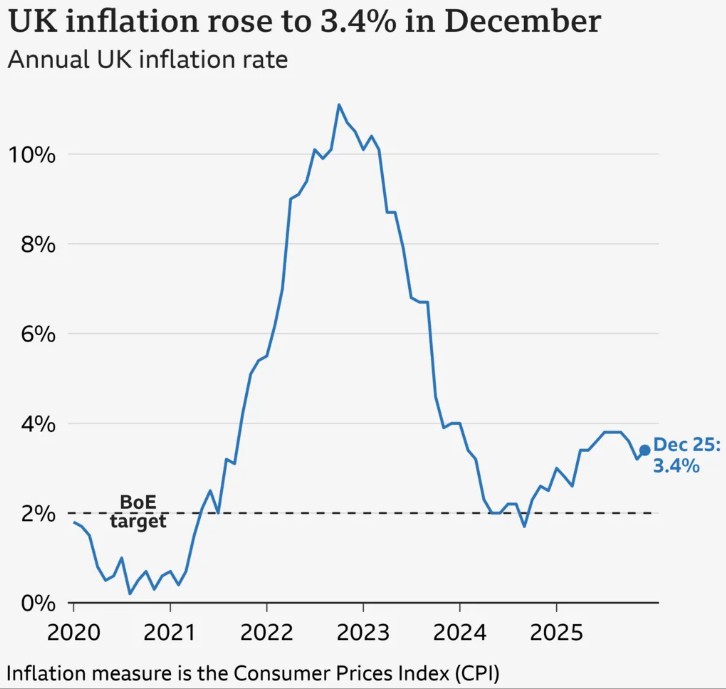

UK inflation has climbed to 3.4% in the year to December, driven mainly by higher tobacco prices and a sharp rise in airfares, according to the latest official data from the Office for National Statistics (ONS).

This marks the first increase in inflation in five months, coming in slightly above economists’ expectations of 3.3%.

The figures arrive at a crucial moment, just weeks before the Bank of England’s February interest rate decision, and will be closely watched by households, businesses, and policymakers across the UK.

What Is Driving UK Inflation Higher in December?

Why did tobacco prices increase?

One of the biggest contributors to rising UK inflation was tobacco. The ONS confirmed that a tobacco duty rise introduced in late November fed directly into higher prices paid by consumers in December.

ONS Chief Economist Grant Fitzner said: “Tobacco prices rose strongly following the increase in duty introduced at the end of November.”

This meant smokers felt the impact almost immediately at shop tills across the country.

Why did airfares jump so sharply?

Airfares were another major upward driver, with transport prices rising by 4% over the 12 months to December.

The ONS said this was largely due to the timing of Christmas and New Year return flights.

🚨 Breaking — UK inflation is back up: CPI 3.4% (from 3.2%).

💥 Higher than Germany (2.0%) and France (0.7%).

📌 Part of the December rise is tax-driven.

Self-inflicted damage yet again. pic.twitter.com/b1d57rwu6P

— Jamie Jenkins (@statsjamie) January 21, 2026

ONS statement: “Air fares rose by more than last year, likely because of the timing of return flights over the Christmas and New Year period.”

In December 2023, flight prices were recorded on Christmas Eve and New Year’s Eve, while in 2024 they were measured earlier, on 23 and 30 December, capturing more expensive return fares.

Are Food Prices Still Rising in the UK?

Yes, but at a slower pace than earlier in the year.

Which foods are pushing inflation up?

Food and non-alcoholic drinks prices rose by 4.5% year-on-year

Biggest contributors:

- Bread and cereals

- Vegetables

These everyday staples continue to strain household budgets, particularly for lower-income families.

What helped offset price rises?

Some relief came from:

- Slower rent inflation

- Lower prices for recreational and cultural goods, such as leisure activities and entertainment

This helped prevent inflation from rising even further.

How Does UK Inflation Compare With Europe?

The UK continues to record higher inflation than several major European neighbours.

| Country | Inflation Rate (Year to December) |

|---|---|

| United Kingdom | 3.4% |

| Germany | 2.0% |

| France | 0.7% |

It has now been over a year since UK inflation was lower than Germany’s, highlighting ongoing cost pressures unique to the UK economy.

What Is the Consumer Price Index (CPI)?

UK inflation is measured using the Consumer Prices Index (CPI).

How does CPI work?

Based on a “basket” of hundreds of everyday goods and services

Includes items like:

- Bread, fruit, clothing

- Furniture

- Transport and household bills

Prices are tracked over 12 months

The basket is regularly updated to reflect how people actually shop in the UK

This makes CPI the most widely used and trusted inflation measure.

What Are Politicians Saying About Rising UK Inflation?

Government response

Chancellor Rachel Reeves said tackling the cost of living remains her top priority.

Rachel Reeves said: “Money off bills and into the pockets of working people is my choice. There’s more to do, but this is the year that Britain turns a corner.”

She pointed to the November Budget measures, including:

- A freeze on rail fares

- A freeze on prescription charges

Opposition response

Shadow Chancellor Mel Stride blamed the rise on government policy.

Mel Stride said: “A record-high tax burden and irresponsible borrowing are stifling growth and fuelling inflation – leaving working people worse off.”

Why Do These Figures Matter for Interest Rates?

This is the last inflation report before the Bank of England’s February meeting.

- Higher inflation reduces the chances of early interest rate cuts

- Mortgage holders and borrowers may face higher costs for longer

- Savers could continue to benefit from higher interest returns