The FTSE 100 is on course for a noticeably rough opening moment, with the UK’s blue-chip indicator anticipated to fall sprucely as global requests continue to wobble.

Early trading signals point to a bigger-than-usual slide, with investors responding nervously to late losses across Wall Street and Asia.

Global Market Slide Sends FTSE 100 Lower

Jitters ahead of Nvidia’s results and Thursday’s labour market update rattled US markets, leaving the Dow Jones down 1.2% and the S&P 500 off by 0.9%.

That pessimism carried straight through into Asian trading hours.

The Nikkei 225 tumbled further than 3, hit by renewed worries over tech valuations and a rising political row between Japan and China.

Hong Kong’s Hang Seng index also slipped 2%, adding to the sense of apprehension in global equities.

FTSE 100 Performance in London

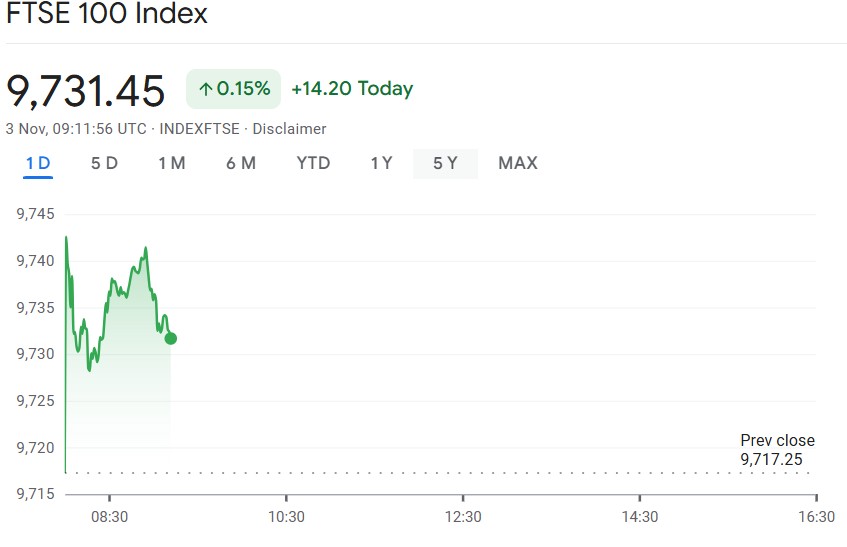

Then in London, the FTSE 100 closed 0.2% lower at 9675.43 on Monday, and IG futures are now pointing to a decline of around 130 points, or roughly 1.3%, at the opening bell.

For everyday investors, that basically means sentiment is shaky as dealers digest a blend of global pressures, commercial earnings fears, and threat-off gestures.

Commodity markets aren’t offering much comfort either. Gold has dipped to $4014 an ounce, while Brent Crude has eased to $63.79 a barrel, reflecting a broader cooling in demand expectations.

Energy stocks and mining shares, often big drivers of FTSE 100 performance, may struggle to find momentum as a result.

Bitcoin Falls Below $90,000

Bitcoin is also extending its downtrend. After another 3% drop, the cryptocurrency has slipped below $90,000, a sharp retreat considering it was swimming close to $125,000 in early October. The withdrawal adds further pressure to sentiment across the wider threat- asset geography.

For UK investors keeping an eye on the FTSE 100, the request mood moment sits forcefully on the conservative side.

With global stock indicators under strain and jitters grandly ahead of crucial profitable data, dealers are bracing for a choppy session and potentially further volatility throughout the week.