As the financial landscape in the UK continues to evolve, finding the right savings account is more important than ever. If you’re looking to grow your savings while navigating fluctuating interest rates, NatWest offers a variety of savings accounts designed to meet different needs. But with so many options available, one question stands out: What is the best NatWest savings account? In this comprehensive guide, we’ll explore the top savings options from NatWest, how they compare, and which one might be the perfect fit for your financial goals.

What Makes a Savings Account the Best Choice?

Before diving into the specifics of NatWest’s savings accounts, it’s crucial to understand what makes an account stand out. While the best account for you may vary depending on your unique needs, several key factors should be considered:

- Interest Rate: A higher interest rate can help your savings grow faster. However, keep in mind that rates may fluctuate, especially in variable accounts.

- Access to Funds: Some accounts allow instant access, while others require a commitment to leave your money untouched for a set period.

- Fees and Penalties: Always check for any maintenance fees or penalties for early withdrawal, which can impact your savings.

- Flexibility and Features: Look for additional benefits like cashback, rewards, or round-ups to enhance your savings experience.

What Is the Best NatWest Savings Account for Regular Savers?

If you’re someone who prefers to save consistently each month, the Digital Regular Saver might be the perfect match for you. But what makes it stand out from the rest of NatWest’s savings offerings?

Why Choose the Digital Regular Saver?

The Digital Regular Saver is ideal for individuals who want to build their savings gradually, with a set monthly deposit. Here’s why it could be considered one of the best NatWest savings accounts:

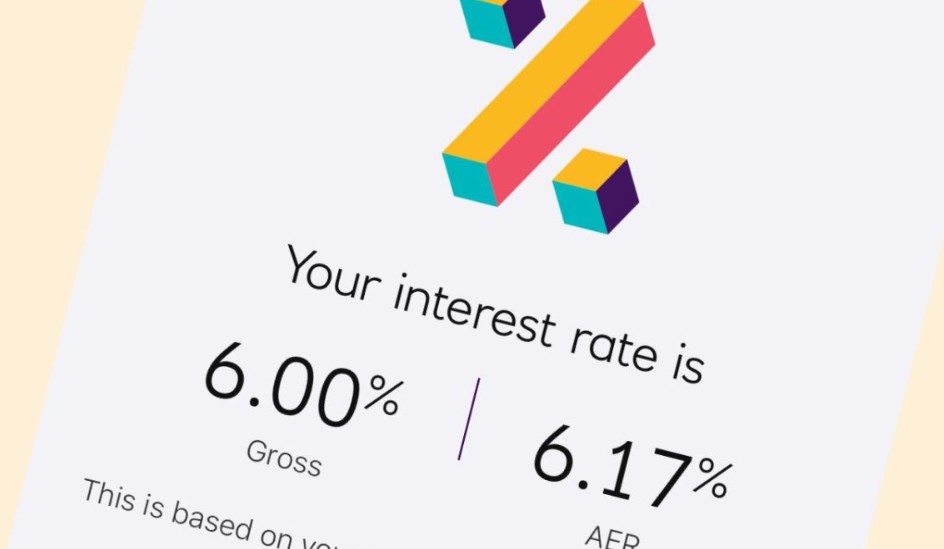

- Competitive Interest Rates: Offers 6.17% AER (variable) on balances up to £5,000, which is one of the most attractive rates available for regular savers.

- Deposit Flexibility: You can deposit between £1 and £150 each month, helping you stay on track with your savings goals.

- Instant Access: Unlike some savings options, this account allows immediate access to your funds without penalties, so you’re never locked in.

- Eligibility: Available to NatWest current account holders aged 16 and over.

In short, if you want to regularly save with the benefit of high interest and flexibility, this account is a top contender for the title of the best NatWest savings account.

Which NatWest Savings Account Offers Flexibility with Competitive Rates?

Do you need a savings account that offers the flexibility to access your funds at any time, but also provides a competitive interest rate? The Flexible Saver might be just what you’re looking for.

What Makes the Flexible Saver Stand Out?

For many people, access to their savings when needed is crucial. However, you don’t have to sacrifice a good interest rate to maintain that flexibility. The Flexible Saver offers the best of both worlds:

- Tiered Interest Rates:

- £1 to £24,999: 1.25% AER

- £25,000 to £99,999: 1.85% AER

- £100,000 to £249,999: 2.10% AER

- £250,000 and above: 2.70% AER

- Instant Access: You can withdraw your money at any time without penalties, making it an excellent choice for those who need liquidity.

- Additional Features: The account allows you to participate in NatWest’s Round Up program, where you can round up purchases to the nearest pound and save the difference.

With its strong interest rates and the ability to access your funds when you need them, the Flexible Saver is perfect for those who want to balance earning a solid return while maintaining flexibility.

Are Tax-Free Savings Options Important to You?

If you’re looking to maximize your savings with tax-free interest, the Cash ISA from NatWest could be the right fit. But why should you consider a Cash ISA, and how does it compare to other options?

Why Choose a Cash ISA from NatWest?

A Cash ISA allows you to save money without paying tax on the interest earned, provided it stays within the yearly ISA allowance. This is a significant advantage for high earners or anyone looking to keep their savings growing without the tax burden.

- Interest Rates:

- £1 to £24,999: 1.40% AER (variable)

- £25,000 and above: 2.70% AER (variable)

- Tax Benefits: The interest you earn is tax-free, which means you keep more of what you earn.

- Instant Access: Enjoy the freedom to withdraw funds at any time without facing penalties, though your ISA allowance is limited annually.

- Who can apply: Open to individuals aged 18 or older who currently reside in the UK.

A Cash ISA is ideal if you want a safe, tax-efficient place to store your savings while still maintaining the ability to access your funds.

Is a Fixed-Rate Account the Best Option for You?

If you prefer the peace of mind that comes with guaranteed returns over a set period, a Fixed Term Savings Account from NatWest might be the answer. But how do fixed-term accounts work, and what are the benefits?

What Are the Benefits of Fixed-Term Savings Accounts?

With a Fixed Term Savings Account, you commit your funds for a specific period, during which you earn a fixed interest rate. This guarantees you know exactly what your return will be, making it a low-risk option for savers.

- Interest Rates:

- 1-Year Term: 3.90% AER (fixed)

- 2-Year Term: 3.75% AER (fixed)

- Minimum Deposit: You can start with as little as £1.

- Maximum Deposit: Up to £5 million, making it suitable for savers with large sums.

- No Access During Term: Your money is locked in for the term, with penalties for early withdrawal.

If you’re looking for stability and a guaranteed return, a fixed-term savings account could be the right choice for you. It’s perfect for those who don’t need immediate access to their funds and are looking for reliable growth.

Final Thoughts: What Is the Best NatWest Savings Account for You?

Choosing the best NatWest savings account depends on your financial needs and preferences. Here’s a quick recap:

- For Regular Savers: The Digital Regular Saver offers high interest rates with the flexibility of monthly deposits.

- For Flexibility with Competitive Rates: The Flexible Saver provides competitive interest rates with instant access to your savings.

- For Tax-Efficient Savings: The Cash ISA is a great option if you want to save without worrying about taxes on interest.

- For Guaranteed Returns: A Fixed Term Savings Account ensures that your savings grow at a fixed rate, providing certainty.

Ultimately, the best NatWest savings account is the one that aligns with your savings goals and provides the features that matter most to you. Take time to evaluate each account’s terms, interest rates, and features to make an informed decision.

FAQs About NatWest Savings Accounts

How do I open a NatWest savings account?

To open a savings account with NatWest, you must be a UK resident and meet the eligibility criteria for the specific account you wish to open. You can apply online through NatWest’s website or at a branch.

Are my savings protected in NatWest savings accounts?

Yes, NatWest savings accounts are protected by the Financial Services Compensation Scheme (FSCS), meaning your savings are protected up to £85,000 per person, per bank.

Can I access my savings instantly with all NatWest accounts?

Not all NatWest savings accounts offer instant access. For example, the Fixed Term Savings Accounts lock your funds for the term, while the Digital Regular Saver and Flexible Saver provide immediate access.

Is there a fee to maintain my NatWest savings account?

Most NatWest savings accounts are free to maintain. However, there may be fees for specific services or penalties for early withdrawals, particularly in fixed-rate accounts.