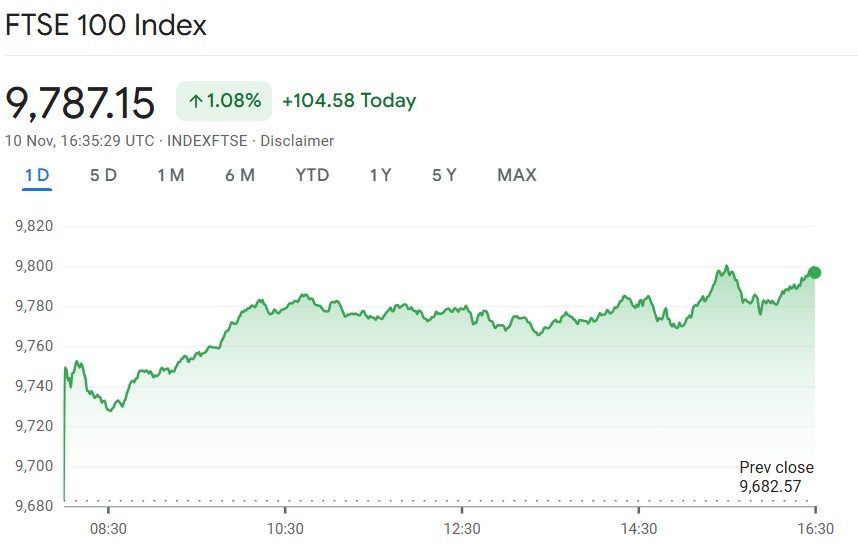

The FTSE 100 soared to record heights on Monday, breaking through the 9,800 hedge for the first time in history, as sanguinity swept through global markets over signs the United States government arrestment could soon be resolved.

The London Stock Exchange’s standard indicator closed up 104.58 points, or 1.1%, at 9,787.15, marking a fresh record closing high after touching an intra-day peak of 9,800.35.

The rally echoed across the UK request, with the FTSE 250 gaining 0.9% to 21,968.27, while the AIM All-Share advanced 1.1% to 757.54.

Global sentiment turns positive

Investors shifted towards riskier assets after the US Senate moved closer to ending the country’s longest-ever government shutdown. The vote to reopen federal agencies was seen as a significant step toward resolving weeks of political gridlock in Washington.

“The prospect that the longest US government shutdown in history may end in the next few days has bolstered risk appetites,” said Marc Chandler of Bannockburn Capital Markets.

European and US markets rally

Across Europe, optimism was just as evident. The CAC 40 in Paris jumped 1.5%, while Frankfurt’s DAX 40 surged 1.7%.

Stateside, Wall Street traded higher, with the S&P 500 up 0.7% and the Nasdaq Composite gaining 1.3%, though the Dow Jones Industrial Average held steady near its previous close.

Tech stocks were the standout performers. Nvidia climbed 3.9% ahead of next week’s results, while AMD leapt 5.7% ahead of its analyst day presentation.

According to Morgan Stanley, the latest developments could bring the shutdown to an end within days. The bank anticipates the September employment report to be the first key economic data released after government operations resume.

“We think the data in hand by the time of the December Fed meeting will be enough for them to cut,” Morgan Stanley noted.

Boost for UK blue chips

Back in London, the positive sentiment lifted several heavyweight names on the FTSE 100.

Golden miners Fresnillo and Endeavour Mining surged 5.4% and 4.5% independently, driven by stronger bullion prices, with gold trading at$ 4,091.42 an ounce, up from$ 4,012.24 on Friday.

Diageo impressed investors with a 5.2% rise after publicising the appointment of former Tesco master Dave Lewis as its incoming CEO.

The drinks giant, owner of Guinness and Johnnie Walker, praised Mr Lewis’s experience in brand transformation and cost management.

Jefferies analyst Edward Mundy remarked that the move “ends the uncertainty over leadership transition and brings a heavyweight leader with extensive CEO experience on both brand building and transformation.”

Broader market movers

Away, Entain jumped 3% after an upgrade from Investec, while IAG, parent company of British Airways, rebounded 3.7% following sharp losses last week.

On the FTSE 250, RHI Magnesita surged 17% after posting stronger- than- anticipated results for the alternate half of 2025.

In discrepancy, JTC slipped 4.3% after agreeing to a£ 2.7 billion preemption by Permira Advisers, sparking disappointment among investors who had hoped for an advanced shot.

“We are not convinced that this is yet a done deal,” warned RBC Capital Markets.

Currency and commodity updates

Sterling edged lower, trading at $1.3160, while the euro weakened to $1.1554. The US dollar gained ground against the yen, fetching ¥153.97. Yields on US Treasuries also ticked higher, with the 10-year rising to 4.11%.

Brent crude oil slipped slightly to $63.45 a barrel, easing from $63.51 late Friday.

Political and economic outlook

Attention now turns to the forthcoming UK Budget at the end of November. Chancellor Rachel Reeves told the BBC the government remains concentrated on driving down the cost of living, reducing public debt, and addressing NHS waiting lists.

It’ll be a “difficult” Budget, she admitted, but one centred on “fairness” and long- name profitable growth.

Request watchers will be keeping an eye on Tuesday’s profitable timetable, featuring UK jobs data and the British Retail Consortium’s retail deals examiner.

Investors are also awaiting half-time results from Vodafone and DCC, which could give further insight into the UK commercial earnings outlook.

For now, the limelight remains on the FTSE 100, which continues to shine brighter than ever, a symbol of request confidence returning after months of global query.