The FTSE 100 slipped on Tuesday, dragged lower by losses in Marks & Spencer shares after the retail mammoth revealed its gains had been nearly canceled by a major cyber attack before this year.

Marks & Spencer( M&S) reported a shocking collapse in its half-time gains, saying that statutory pre-tax earnings for the six months to 27 September plunged to just £3.4 million, compared with£ 391.4 million a year ago.

The blow came despite £100 million in insurance recoveries linked to the incident that paralysed its operations in April.

Adjusted profits also slumped by more than half to £184.1 million, reflecting a steep hit to trading and an estimated £50 million in additional costs during the period.

Chief executive Stuart Machin sought to reassure investors, stating: “We are confident we will be recovered and back on track by the financial year end.”

He added that M&S remained “well placed for a return to growth,” although the market wasn’t convinced. Shares in the high street favourite dropped 3.5p to 381p, extending the slide from last week’s 405p.

FTSE 100 Feels the Pressure

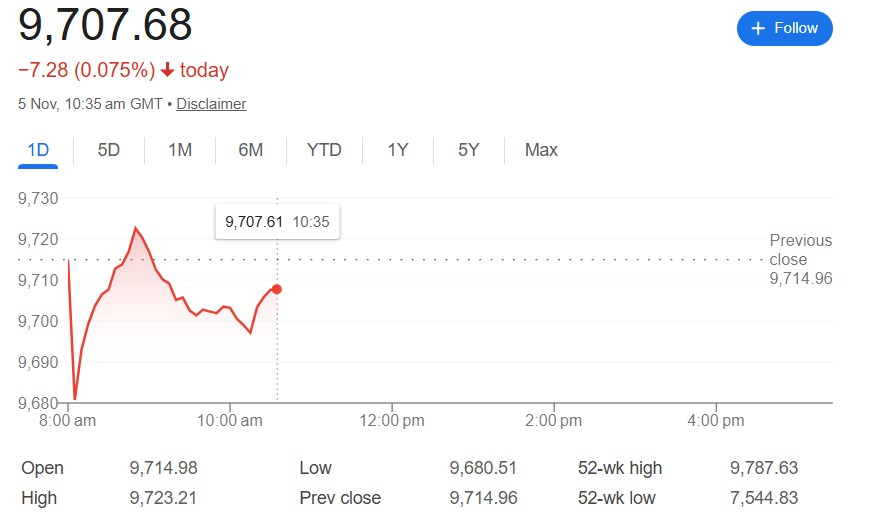

The FTSE 100 indicator imaged the retail jitters, edging 10.64 points lower to 9707.68.

The mood was conservative following a bruising Wall Street session in the week, where US markets tumbled on renewed concerns over inflation and interest rate paths.

Still, some adaptability was noted among select sectors. Housebuilder Barratt Redrow gained 4p to 376.2 p after reporting an 8 rise in completions and reaffirming its full-time outlook, a rare bright spot in an otherwise muted trading day.

In discrepancy, trip tech establishment Trainline handed a spark in the mid-cap FTSE 250, rising 5 (12.6 p) to 267p. The swell followed upbeat interim results and an upgraded earnings cast.

The company now expects earnings growth of 10 to 13, up from a former estimate of 6 to 9, buoyed by rising digital ticket deals and robust commuter demand.

Interim gains climbed 14% to £93 million, signalling strong initiation heading into the alternate half of the year.

Market Outlook

Analysts say the latest volatility underlines the fragility of investor sentiment amid global market unease.

The FTSE 100, often viewed as a barometer for UK corporate health, remains sensitive to international pressures, from US economic data to currency movements.

M&S’s profit collapse highlights how vulnerable even established British brands remain to digital threats. The retailer’s promise of a second-half recovery will now be closely scrutinised by shareholders keen to see evidence of a turnaround before year-end.

For now, the FTSE 100 continues to tread cautiously, but is shadowed by lingering uncertainty.